FOI to the ATO, Zarina Khan, 17th June 2023

On 17 June 2023, you requested access to documents relating to the following:

1. Document relied upon that demonstrates the instrument used to create the Australian Taxation Office

2. Document relied upon that demonstrates the execution (date, day, time} for the Australian Taxation Office

3. Document relied upon that demonstrates the Australian Taxation Office was legally registered

4. Document relied upon that demonstrates the Australian Taxation Office was Gazetted as a legal

entity

5. Document relied upon that demonstrates the Trust Deed between Australian Taxation Office and Zarina Khan (named organisation representative ASIC page)

Decision letter ZK20230629 Decision letterRedacted (pdf)

Point 5

A document is exempt under section 38 of the FOI Act if disclosure of the document, or information contained in the document, is prohibited under a secrecy provision set out in Schedule 3 to the FOI Act.

Relevantly, section 355–25 in Schedule 1 to the TAA is specified in Schedule 3 to the FOI Act. Section 355–25 prohibits me from disclosing protected information to an entity other than the entity to whom the information relates or an entity covered by subsection 355–25(2) in Schedule 1 to the TAA.

‘Protected information’ is defined in section 355–30 of Schedule 1 to the TAA as information which was disclosed or obtained under or for the purposes of a taxation law, which relates to the affairs of an entity, and which identifies, or is reasonably capable of being used to identify, the entity.

I am satisfied that, should any documents exist in relation to point 5 of your request, they would contain information relating to the affairs of identifiable entities that was obtained by ATO officers for the purposes of taxation laws, and that any such documents would contain ‘protected information’ about the entities.

I am not satisfied that you are an entity to whom the ‘protected information’ relates or a covered entity in relation to any such entity (as defined by subsection 355–25(2) of Schedule 1 to the TAA). As a result, I am prohibited by section 355–25 of Schedule 1 to the TAA from disclosing ’protected information’ about these entities to you.

Accordingly, I find that if there are any documents that fall within the scope of point 5 of your request, any such documents would be exempt from disclosure to you under section 38 of the FOI Act.

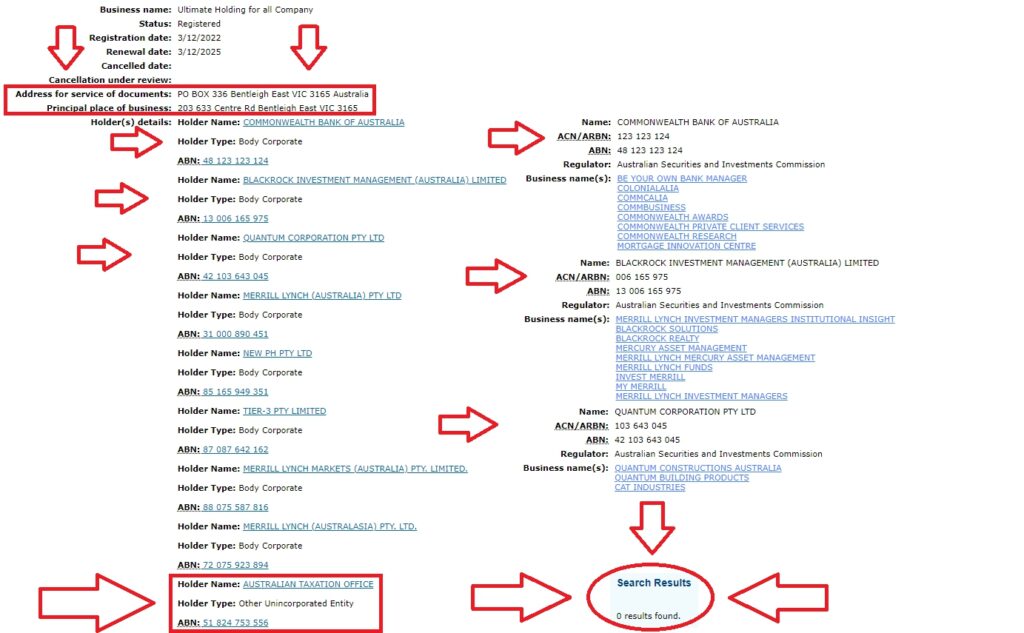

December 2022 listing for Ultimate Holding for all Company:

Some of these ABNs were registered to well-known financial institutions and investment entities, and some of these ABNs were registered to entities you may have yet to hear of, but they are all significant. The entities listed below had their ABNs registered on the third of December, 2022. All on the same day, it needs to be clarified why or what the real impacts of it are.

- COMMONWEALTH BANK OF AUSTRALIA (ABN 48 123 123 124)

- MERRILL LYNCH (AUSTRALIA) proprietary limited (ABN 31 000 890 451)

- BANK OF AMERICA, NATIONAL ASSOCIATION (ABN 51 064 874 531)

- NEW PH proprietary limited (ABN 85 165 949 351)

- QUANTUM CORPORATION proprietary limited (ABN 42 103 643 045)

- MERRILL LYNCH MARKETS (AUSTRALIA) proprietary limited

(ABN 88 075 587 816) - MERRILL LYNCH (AUSTRALASIA) proprietary limited (ABN 72 075 923 894)

- BLACKROCK INVESTMENT MANAGEMENT (AUSTRALIA) LIMITED (ABN 13 006 165 975)

- The Trustee for Patricia Holdings Trust (ABN 43 264 414 938)

- TIER-3 proprietary limited (ABN 87 087 642 162)

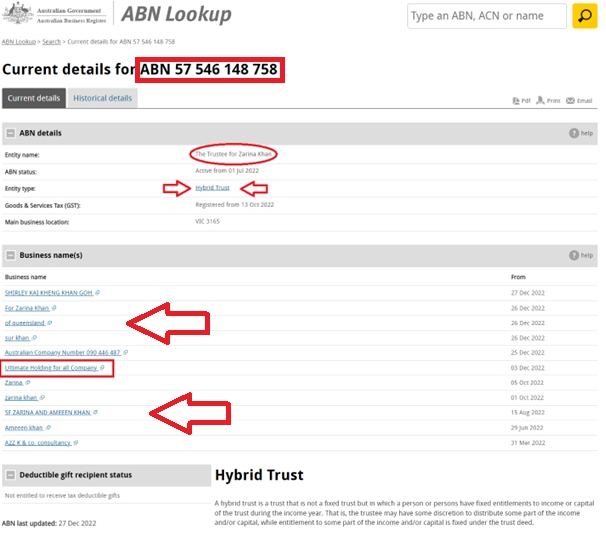

- The Trustee for Zarina Khan (ABN 57 546 148 758 )

- AUSTRALIAN TAXATION OFFICE (ABN 51 824 753 556)

December 2022 records on video:

December 2022 records and video from https://ancop.au/ato-ultimate-holding-for-all-company/

ABN lookup for ATO (ABN 51 824 753 556)

on Wayback Machine, 2nd August 2021, shows (Business name of the Australian Taxation Office):

| Business name | From |

|---|---|

| SUBLIME AUTO DETAILING |

13 Jul 2021 |

ATOCurrent details for ABN 51 824 753 556 ABN Lookup (pdf printed from Wayback Machine archive 2nd August 2021)

May2023Historical details for ABN 51 824 753 556 ABN Lookup (pdf printed from Wayback Machine archive 23 May 2023)

ASIC records 2023

Name: Ultimate Holding for all Company

Date/Time: 9 February 2023 AEST: 7:52:37 am

Who runs the ATO Ultimate Holding for all Company (pdf from the ASIC website)

Business name details

Extracted from ASIC’s database at AEST 11:03:32 on 14/02/2023

ATO-ASIC_uhfc (pdf)

Business name details

A2Z K & co. consultancy

A2K_KSearch ASIC Registers (pdf)

ABN Lookup

Search results – active ABNs and names ABN Lookup (pdf) “A2Z K & co. consultancy”

Current details for ABN 38 810 455 847 _ ABN Lookup (pdf) “A2Z K & co. consultancy” and

Current details for ABN 38 810 455 847 _ ABN Lookup ( pdf) “Zarina Khan”

Current details for ABN 57 546 148 758 _ ABN Lookup (pdf) “A2Z K & co. consultancy” and

Current details for ABN 57 546 148 758 _ ABN Lookup (pdf) “The Trustee for Zarina Khan”

Current details for ABN 49 116 162 442 _ ABN Lookup (pdf) “KAHGOH PTY LTD” Business name: A2Z K & co. consultancy

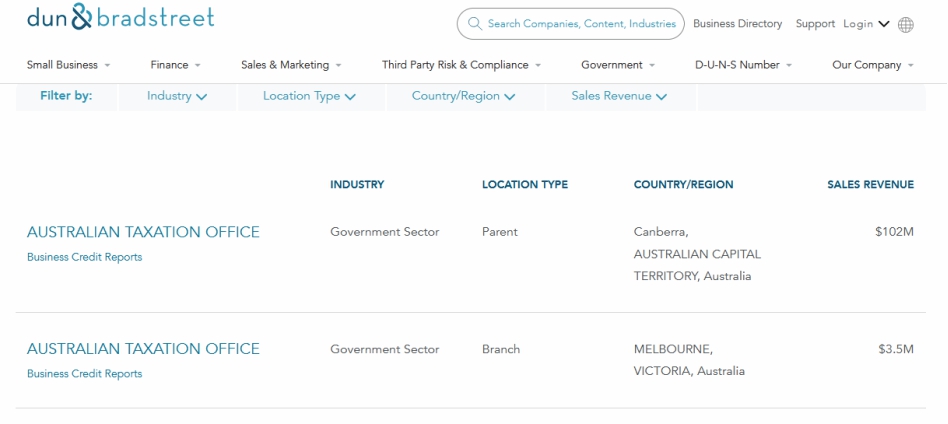

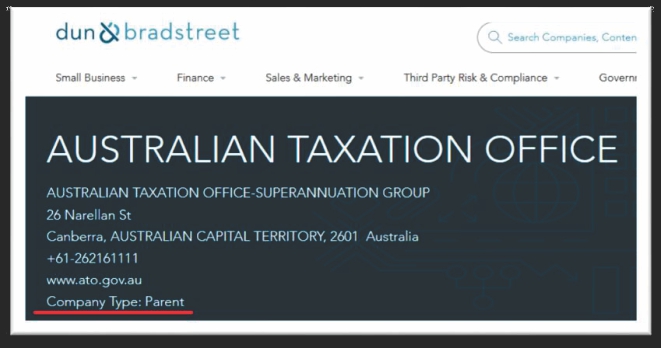

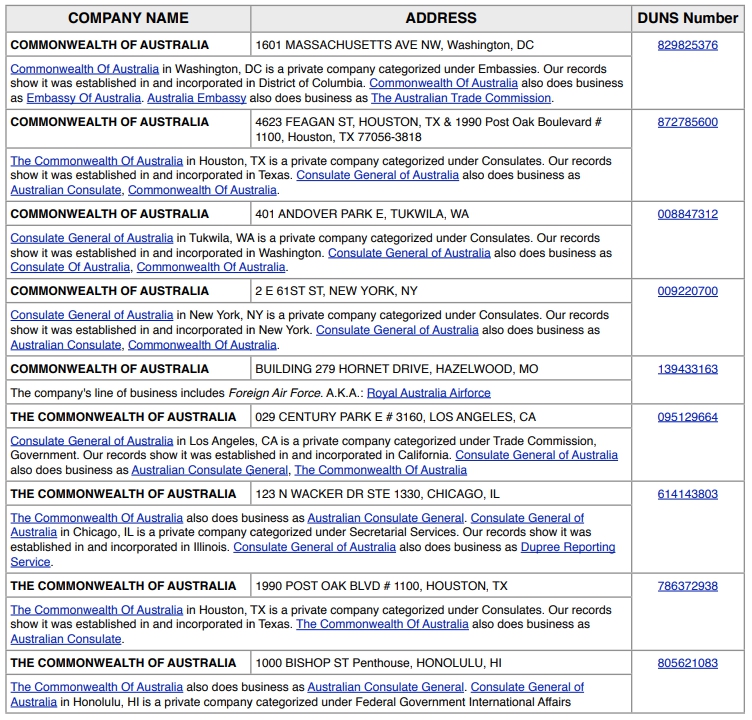

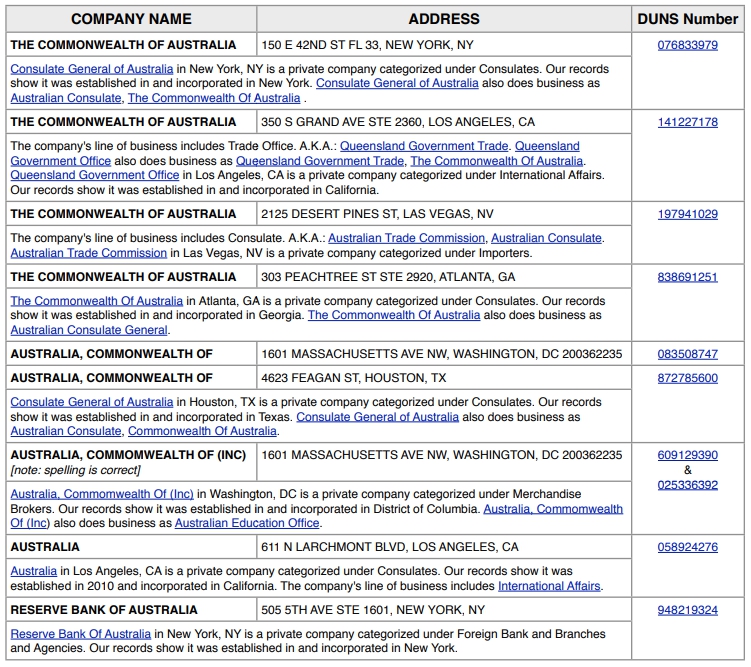

Dun and Bradstreet

DNB_The Trustee for ZARINA KHAN Company Profile _ MERRYLANDS, NEW SOUTH WALES, Australia _ Competitors, Financials & Contacts – Dun & Bradstreet (pdf) Dun and Bradstreet Company Profile “The Trustee for Zarina Khan”

Commonwealth Entities

Public Governance, Performance and Accountability Act 2013 Pg25 (pdf)

https://www.legislation.gov.au/Details/C2017C00269 (URL)

11 Types of Commonwealth entities

There are 2 types of Commonwealth entities:

(a) a corporate Commonwealth entity, which is a Commonwealth entity that is a body corporate; and

(b) a non-corporate Commonwealth entity, which is a Commonwealth entity that is not a body corporate.

Note: Corporate Commonwealth entities are legally separate from the Commonwealth, whereas non-corporate Commonwealth entities are part of the Commonwealth.

Chart of Commonwealth Entities and companies (189)

From the Department of Finance

Flipchart_of_PGPA_Act_Commonwealth_entities_and_companies_189_3 (pdf)

INTERPRETATION ACT 1984 – SECT 76A

INTERPRETATION ACT 1984 – SECT 76A (pdf)

76A. Written laws made before Australia Acts, validity of

(1) Each provision of an Act or subsidiary legislation enacted or made, or purporting to have been enacted or made, before the commencement of the Australia Acts —

(a) has the same effect as it would have had; and

(b) is as valid as it would have been,

if the Australia Acts had been in operation at the time of its enactment or making, or purported enactment or making.

(2) Subsection (1) is not intended to, and is not to be given effect so as to —

(a) invalidate any enactment that was valid immediately before the commencement of the Australia Acts; or

(b) invalidate any Act because it was assented to by the Sovereign rather than the Governor.

********************

The first point of interest for the ASIC link from the Australian Taxation Office is the postage address – PO Box 336 Bentleigh East VIC 3165 Australia, this will come up soon. The Principal place of business 203 633 Centre Rd Bentleigh East VIC 3165 is found with a search to be not a place of business but a two-bedroom apartment that is up for rent.

Realestate.com

https://www.realestate.com.au/property/flat-203-633-centre-rd-bentleigh-east-vic-3165

Domain.com

https://www.domain.com.au/property-profile/203-633-centre-road-bentleigh-east-vic-3165

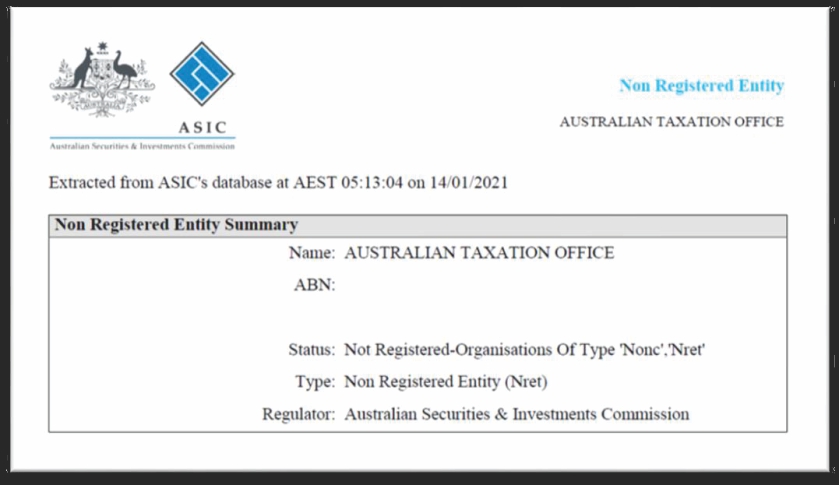

The number of various financial institutions on this list along with the Australian Taxation Office demonstrates that this is not a Commonwealth Government Entity as displayed on the ABN page previously. Holder type for the ATO has now changed to display Other Unincorporated Entity, this inconsistency in entity structure is consistent for the ATO to be a Private Trust held in private hands making it no Commonwealth Government Entity. When the ATO is selected no results are found, as the ATO is unregistered.

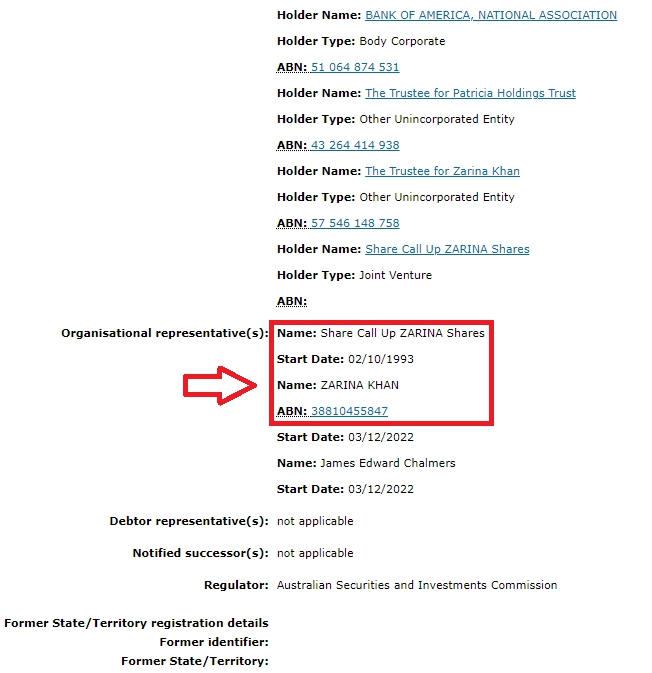

Going back to the ASIC page from earlier down the page the Organisational representative(s) are named to be ZARINA KHAN and James Edward Chalmers, an unknown all caps business entity and presumably the Federal Treasurer. ZARINA KHAN needs to be remembered.

Searching the Unlimited Holding for all Company ABN it is revealed to be named The Trustee to Zarina Khan as well as being a Hybrid Trust. This Hybrid Trust structure is the reason that the ATO is not registered on ASIC and that many a judge as well as ATO representative have confirmed that the ATO is not a legal personality/entity, as it is in a nonlegal Hybrid Trust/Private Trust arrangement, webbed deeply within what and whoever Zarina Khan may be.

When searching the business names for Unlimited Holding for all Company, the postal address mentioned previously, PO Box 336 Bentleigh East VIC 3165 Australia, is reoccurring. A second name begins to surface, Ameeen Khan, and like the Unlimited Holding for all Company, the Principal business address is 203 633 Centre Rd Bentleigh East VIC 3165 – far too many coincidences.

https://abr.business.gov.au/ABN/View?abn=57546148758

Current details for ABN 57 546 148 758 ABN Lookup (pdf of the page above on 28th July 2023).

From the ABN lookup page (July 28th 2023):

| Business name | From |

|---|---|

| SHIRLEY KAI KHENG KHAN GOH |

27 Dec 2022 |

| For Zarina Khan |

26 Dec 2022 |

| of queensland |

26 Dec 2022 |

| sur khan |

26 Dec 2022 |

| Zarina |

05 Oct 2022 |

| zarina khan |

01 Oct 2022 |

| SF ZARINA AND AMEEEN KHAN |

15 Aug 2022 |

| Ameeen khan |

29 Jun 2022 |

| A2Z K & co. consultancy |

31 Mar 2022 |

Search ASIC Registers (pdf of the listed item “zarina khan” above)

ABN 57 546 148 758

The Trustee for Zarina Khan

Hybrid Trust

A hybrid trust is a trust that is not a fixed trust but in which a person or persons have fixed entitlements to income or capital of the trust during the income year. That is, the trustee may have some discretion to distribute some part of the income and/or capital, while entitlement to some part of the income and/or capital is fixed under the trust deed.

https://abr.business.gov.au/ABN/View?abn=57546148758

Although unusual that a government entity would require an ABN and ASIC registry, the Australian Taxation Office stands alone in it has the business name that links to many other entities. Centrelink, Medicare, courts, schools, hospitals, Local Government, Police and Fire Departments when searched had no affiliated business name that linked to any type of Trust.

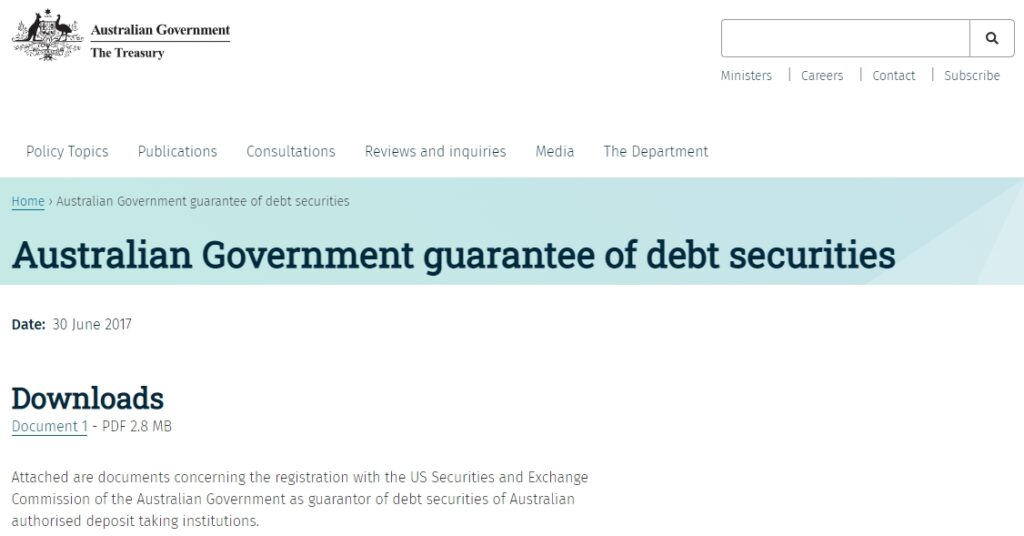

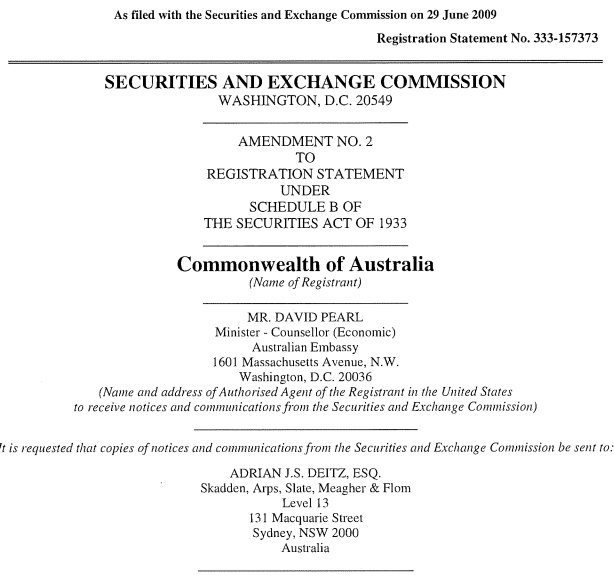

Like many of the above government services the Australian Taxation Office is registered with the United States Securities and Exchange Commission. Why a supposed sovereign nation would be registered on the exchange of another nation in the form of a company remains a secret to the Australian people.

The ATO located in the ACT appears as the “parent”, with each other capital city having its own ATO listed as “branch”. Franchise will use the corporate terms “parent/branch” to indicate the HQ and its subsidiaries.

The ATO is listed as a company in the government sector, this illustrates the ATO is an agent or agency. For a company to be operating without registration would be illegal unless the company was a private entity or nonlegal not to be confused with illegal.

The evidence is stacking up that neither the Australian Taxation Office nor the Commonwealth Government of Australia is a de jure legitimate democratic representative beholden to the Commonwealth of Australia Constitution 1901. Both Dick Yardley in his ground breaking book “Australian Political & Religious Leaders TREASON Treachery & Sabotage” and David Walters Petition of Right presented to Queen Elizabeth and the High Court of Australia, backs up Dick Yardley’s findings with the added prima facia evidence of the Petition not being rebutted in the High Court instead putting his case on a permanent stay.

David Walter Petition

Australian Treasury

https://treasury.gov.au/foi/documents-relating-to-registration-with-the-sec

Securities and Exchange Commission

https://treasury.gov.au/sites/default/files/2019-03/FOI_2117_T198654.pdf

Australis-Commonwealth-DUNS-numbers (pdf)

Public or Private?

FOI request 27 April 1999 Douglas J Cameron

With regards the creation of the Australian Taxation Office (AT) I was able to ascertain that the ATO was created as a branch of the Commonwealth Public Services by an executive Instrument in 1973 …..

An extensive search of the ATO library and records management system failed to identify any document relevant to this part of your request. Similarly, enquiries to the Commissioners office, People and Structure Branch, the Delegations and Authorisations Office and the Parliamentary Business Unit did not identify any document.

On the advice of the Australian Government Solicitors Office I contacted the Office of the Official secretary to the Governor-General in an attempt to identify, and obtain a copy of the executive instrument. This office referred me to the Federal Executive Council who then suggested I contact the Australian Archives. A detailed search by all offices failed to locate the relevant document.

Accordingly, I am obliged in terms of section 24A of the Act to deny access to this part of your application on the grounds that I was not able to locate the requested document.

The extensive search of government archives demonstrates that the Australian Taxation Office (ATO) foundational documents are not linked with the Commonwealth Public Services. They are not lost; they are kept in the Private, off the Public government and archive records demonstrating that the Australian Taxation Office is a Private Nonlegal entity with private parties holding the executive instrument that created the ATO, including the minutes of meetings relating to the creation of the ATO.

If it was discovered that the ATOs executive instrument and creation documents had been lost, the personnel involved could have taken the matter to the court and had the missing trust (entity) deeds, using copies of financial statements and minutes of meetings for the trust (entity) to have the court reconstitute the trust (entity) deed, to establish the original trust corpus and the original trustees and the beneficiaries. All government offices in which this request passed through are all high-ranking lawyers, some to the level of Queen’s Counsel, that know the importance of such documents being correctly stored in the government archive. The clear and obvious intention of the officers is to keep these documents archived away in the private and out of the reach of FOI requests

Several of my own FOI requests brought back to me zero documents and/or the information I requested. Those requests were for the very basic pieces of evidence that the Australian Taxation Office is in fact a Government Department created in the correct and true way through the Parliament, Executive Council, Royal Assent, ratified through the High Court and Gazetted for the people to learn of their new government department, created to serve the people.

FREEDOM OF INFORMATION ACT 1982 – SECT 24

Power to refuse request–diversion of resources etc.

(1) If an agency or Minister is satisfied, when dealing with a request for a document, that a practical refusal reason exists in relation to the request (see section 24AA), the agency or Minister:

- must undertake a request consultation process (see section 24AB); and

- if, after the request consultation process, the agency or Minister is satisfied that the practical refusal reason still exists–the agency or Minister may refuse to give access to the document in accordance with the request.

(2) For the purposes of this section, the agency or Minister may treat 2 or more requests as a single request if the agency or Minister is satisfied that:

- the requests relate to the same document or documents; or

- the requests relate to documents, the subject matter of which is substantially the same.

* Interpretations

“agency” means a Department, a prescribed authority or a Norfolk Island authority.

“prescribed authority” means:

(a) a body corporate, or an unincorporated body, established for a public purpose by, or in accordance with the provisions of, an enactment or an Order-in-Council, other than:

- an incorporated company or association; or

- a body that, under subsection (2), is not to be taken to be

- a prescribed authority for the purposes of this Act; or

- the Australian Capital Territory House of Assembly; or

- the Legislative Assembly of the Northern Territory or the Executive Council of the Northern Territory; or

- a Royal Commission; or

- a Commission of inquiry; or

(aa) NBN Co; or

(b) any other body, whether incorporated or unincorporated, declared by the regulations to be a prescribed authority for the purposes of this Act, being:

- a body established by the Governor-General or by a Minister; or

- an incorporated company or association over which the Commonwealth is in a position to exercise control; or

(c) subject to subsection (3), the person holding, or performing the duties of, an office established by an enactment or an Order-in-Council; or

(d) the person holding, or performing the duties of, an appointment declared by the regulations to be an appointment the holder of which is a prescribed authority for the purposes of this Act, being an appointment made by the Governor-General, or by a Minister, otherwise than under an enactment or an Order-in-Council.

Cheque was banked 1972 and then cashed 1973

The Duumvirate December 1972

Following the 1972 federal election, Gough Whitlam was sworn in on the fifth of December 1972 as Prime Minister by the Governor-General, Sir Paul Hasluck, in an unprecedented political move before the votes were fully counted, as well as the handover period in which a former government stays in the driver’s seat but only in a caretaker role as the victorious party moves into office.

During this two-week period right before Christmas, Gough Whitlam and his Deputy, Lance Barnard formed a two-man ministry (duumvirate), divided the ministerial portfolios between them (Whitlam 13, Barnard 14), and made 40 decisions not recorded on the parliamentary session minutes of the meeting. The Executive Council consisted of Gough Whitlam and Lance Barnard; three people are necessary to form a quorum to be able to inform the Governor-General and pass regulations. This was all allowed by the Chief Justice of the High Court, Garfield Barwick, who would have been one of the Governor-General’s advisors.

Executive Instrument for creating the Australian Taxation Office likely occurred in the duumvirate – fifth until the nineteenth of December 1972. The execution date for the ATO likely took place in 1973; neither the executive instrument number, creation, nor execution date has been shared with the public.

As no remedy to recover misplaced or destroyed documents in relation to the ATOs foundational documents has occurred, Gough Whitlam, Lance Barnard, Sir Paul Hasluck and Chief Justice of the High Court, Garfield Barwick have conspired beyond their station and authority to the detriment of the nation.

***The executive instrument is the grounds on which the Australian Taxation Office would base its authority and justification that they have the ability to issue tax liabilities and obligations***

National Archives

Research Guides

Gough Whitlam: Guide to Archives of Australia’s Prime Ministers

Chapter 7 – Prime Ministers, 1972-75

https://www.naa.gov.au/sites/default/files/2020-06/research-guide-gough-whitlam_0.pdf

Duumvirate

On 2 December 1972, Whitlam led the ALP to government for the first time since 1949. Unwilling to wait until all the electorates had been fully counted, the first Whitlam Ministry was in fact a government of two – a duumvirate – Whitlam and his Deputy Leader Lance Barnard. Whitlam allocated himself 13 portfolios and Barnard 14.

The first Whitlam government immediately embarked on a series of actions that did not require legislation, with 40 key decisions made in the first two weeks. It abolished conscription, released draft resistors from prison, negotiated diplomatic relations with the People’s Republic of China, announced a Royal Commission on Aboriginal land rights and re-opened the equal pay case then before the Conciliation and Arbitration Commission.

National Archives of Australia

Whitlam Ministries – Cabinet files, single number series with ‘CL’ prefix,

1972–75 A5931

Recorded by: 1972–75 Cabinet Office (CA 1472)

Canberra 28 metres

This is the main series of correspondence files maintained in the Cabinet Office for the administration of Cabinet business during the period of the Whitlam government.

First Whitlam Ministry decisions and other administrative actions,

1972 A5931, CL48

This is a list of the Duumvirate’s first 40 decisions, as well as press releases and Executive Council decisions. The Department of the Prime Minister and Cabinet’s Secretary, Sir John Bunting, directed his staff to compile the file, recognising the significance ‘for future historians’ of the Duumvirate and its work.

Records may vary slightly in the enumerations of days of the Duumvirate and because public announcements through interviews and press coverage often preceded formal announcements. The chronology has been taken largely from the popular press to give the best sense of how this was experienced, but the press releases give a formal chronology.

Cabinet and Federal Executive Council files

There were three Whitlam ministries between 1972 and 1975. The Duumvirate ran from 5 to 19 December 1972, the second ministry from 19 December 1972 until the re-election of the government in the double dissolution of 18 May 1974, and the third ministry from 12 June 1974 to 11 November 1975.Because of the unusual nature of the Duumvirate, it is sometimes overlooked and the ministry sworn in on 19 December 1972 often referred to as the ‘first ministry’. Some entries show an interchange of headings, as can be seen below.

National Archives of Australia

Whitlam Ministries – Cabinet files, single number series with ‘CL’ prefix,

1972–75 A5931

Recorded by: 1972–75 Cabinet Office (CA 1472)

Canberra 28 metres

This is the main series of correspondence files maintained in the Cabinet Office for the administration of Cabinet business during the period of the Whitlam government. A new file was raised in this series whenever a new matter was referred to the Cabinet Office that could potentially be developed into a submission to Cabinet. A new file number in a simple number sequence was allocated from the register (CRS A5933). 72 Gough Whitlam: guide to archives of Australia’s prime ministers

The file title is normally the subject matter – for example ‘Export of black coal’ or ‘Abolition of means test on age pensions’.

In some cases, a matter may eventually have been resolved through channels outside Cabinet. In most cases, however, a Cabinet submission was developed by the department or minister concerned and a copy of the submission placed on the file in due course. The correspondence on a file documents a submission’s development, its presentation to a meeting, the decision made and the notification of the decision to relevant staff. A ‘CL’ file will therefore contain considerable background information regarding its corresponding submission, which is part of series A5915.

Cabinet business lists (including correspondence) – First Whitlam Ministry, 20 December 1972–A5931, CL1 Part 1

This item was originally titled ‘Second Whitlam Ministry’, but was amended by the department to ‘First Whitlam Ministry’, the title by which it is still identified. However, its contents date from 20 December 1972 and in the now-established terminology for Whitlam ministries, it was indeed the Second Whitlam Ministry. There is no material relating to the First Whitlam Ministry (5–19 December 1972) in the item.

The records show that Whitlam made the first submission to his government’s first Cabinet meeting. It was a proposal to grant an additional week’s annual leave to public servants, bringing the total to four weeks.

Whitlam Ministries – Cabinet Submissions

1972–75 A5915

Recorded by: 1972–75 Cabinet Office (CA 1472)

Canberra 12 metres

This series consists of submissions to Cabinet from ministers and departments during the Whitlam government. Because there were no formal submissions during the term of the First Whitlam Ministry (5–19 December 1972), the items in this series relate to the Second and Third Whitlam ministries only.

Annual leave for Commonwealth staff – Decision 4,

1972 A5915, 1

Whitlam put the first submission to Cabinet.

Inquiry into mass media – submission withdrawn,

1975 A5915, 1552

This submission from Dr Moss Cass proposed extensive reforms to deal with the concentration of media ownership. Options for press reform included an inquiry, creation of a voluntary press council, and the establishment of an Australian Newspaper Commission. The commission would publish a national newspaper ‘to provide a balanced account of all news items’. Following immediate and extensive criticism in the press, the proposal was quietly shelved.

Whitlam Ministries – Folders of Decisions of Cabinet and Cabinet Committees,

1972–75 A5925

Recorded by: 1972–75 Cabinet Office (CA 1472)

Canberra 3 metres

This series is the formal record of decisions made by Cabinet and Cabinet committees during the term of the Whitlam government. Cabinet decisions were immediately distributed to relevant ministers and departments. They effectively constituted authority to the administrative arm of government to implement the expressed will of the government in any particular matter.

Legislation Committee – Cabinet minute – Joint Sitting – Without Submission,

1974 A5925, 2347/LEG

This item is a record of some of the preparations for the anticipated Joint Sitting of parliament required to pass the double dissolution ‘trigger’ Bills. This included the passage of two privileges Bills, one of which contained provisions to ‘permit but not require’ the Joint Sitting to be broadcast on television.

Cabinet Minute – Supply – Without Submission,

20 October 1975 A5925, 4107

This minute is a record of the meeting at which the ALP Caucus debated its response to the Opposition’s strategy of deferring Supply. Caucus supported Whitlam in his determination that the government would not be forced to an election for the House of Representatives. It endorsed a strategy of calling the scheduled half-Senate election if Opposition senators persisted in their refusal to vote on Supply.

Cabinet Notebooks,

1950–95 A11099

Recorded by: 1971–96 Cabinet Office (CA 1472)

Canberra 42 metres

This series consists of notebooks created by the Cabinet Secretariat. The notebooks contain handwritten notes of discussions and decisions made at Cabinet meetings and meetings of Cabinet committees, and occasional ‘other’ Cabinet-level meetings, such as budget discussions.

The purpose of the notes was to accurately record the outcomes of discussions – Cabinet decisions – and to assist in the preparation of the official minutes. The minutes provide a record of decisions made in relation to the matters discussed, not just the listed agenda items. Cabinet decisions are, effectively, orders to the administrative arm of government to implement policy. Cabinet minutes are immediately sent to relevant departmental secretaries for action as required.

To support the principle of Cabinet solidarity (and hence the confidentiality of actual discussions), the Cabinet Secretariat expressly aims for a minimal record output. Its literature maintains that: ‘Cabinet meetings are essentially meetings without record’. It should be understood, then, that these notes neither sought to be, nor needed to be, a verbatim account.

Volumes of original Minute Papers approved by Federal Executive Council,

1901– A1573

Recorded by: 1901– Federal Executive Council (CA 2)

Canberra 159 metres

The Federal Executive Council holds formal executive authority under the Australian Constitution. All serving government ministers (including parliamentary secretaries) are invited to attend meetings, which require a quorum of three. The council’s function is to formally ratify Cabinet decisions and to inform the Governor-General that this has occurred.

This series contains bound volumes of original minute papers, including departmental/agency documents (appointments, regulations, proclamations and so on) signed by the Governor-General and the relevant minister/ parliamentary secretary. It includes records relating to the Loans Affair (minute papers approved 1974–75).

Federal Executive Council – minute papers approved,

1972 A1573, 1972/8

The 1972 volumes include documentation of many important Whitlam government decisions, including a decision made during Whitlam’s earliest days in office to sign two United Nations covenants: The International Covenant on Civil and Political Rights and the International Covenant on Economic, Social and Cultural Rights.

The turbulent time period that surrounds the Edward Gough Whitlam are evidence her on National Archive. It has been rumoured that Prime Minister Whitlam was Fabian Communist, and like all Communists they believe in centralised power with a huger revenue drained from the people to pay for it, the ATO appears to be perfect to fund the Communist Utopia. Whitlam was the first PM to recognise Communist China as well as start Medicaid the precursor for Medicare a bloated and inefficient health system.

But…